Forecast for May 14th, 2012

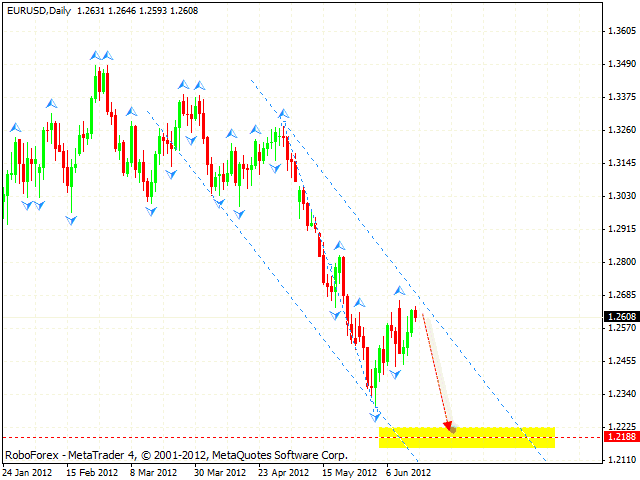

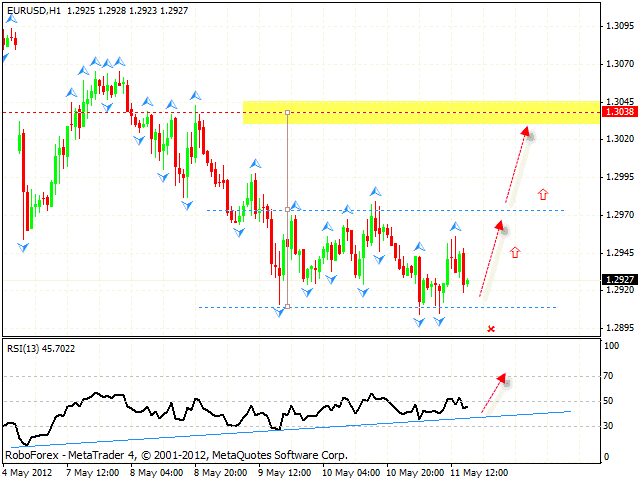

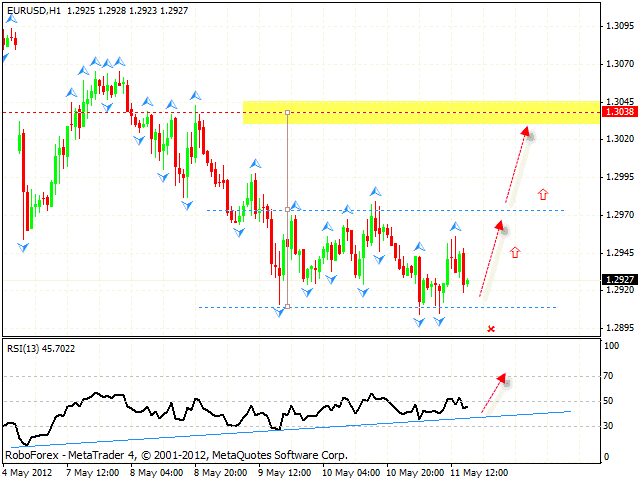

EUR/USD

Just as we expected, the EUR/USD currency pair hasn’t fallen down much.

Currently there is a possibility that the price may form “double bottom”

reversal pattern at the daily chart. If the pair breaks the level of

1.2975, we should expect Euro to continue growing up. The target of the

pattern is the area of 1.3040. Aggressive traders can consider buying

the pair from the current levels with the stop below 1.29.

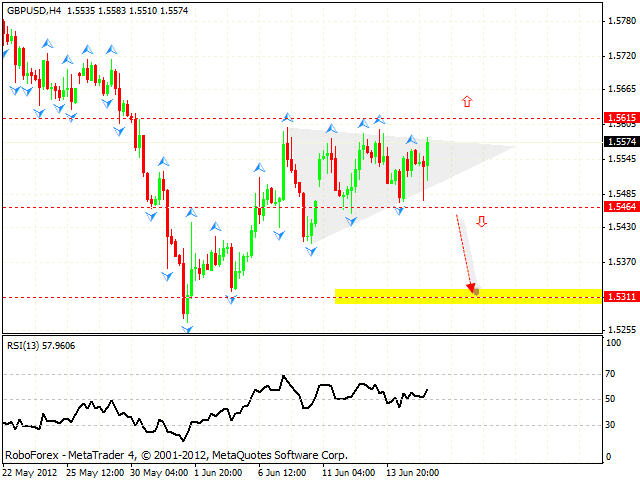

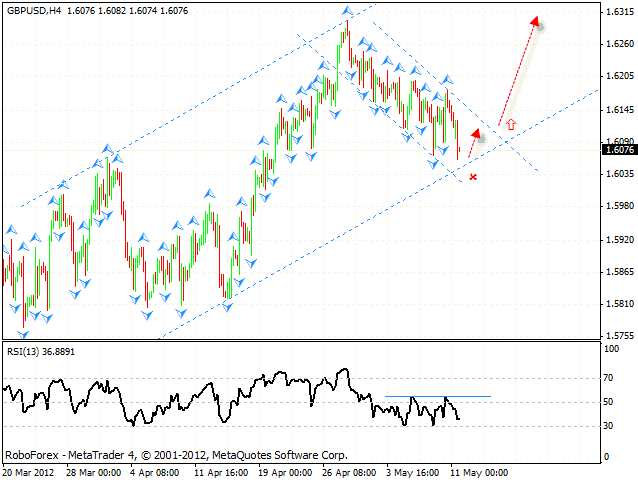

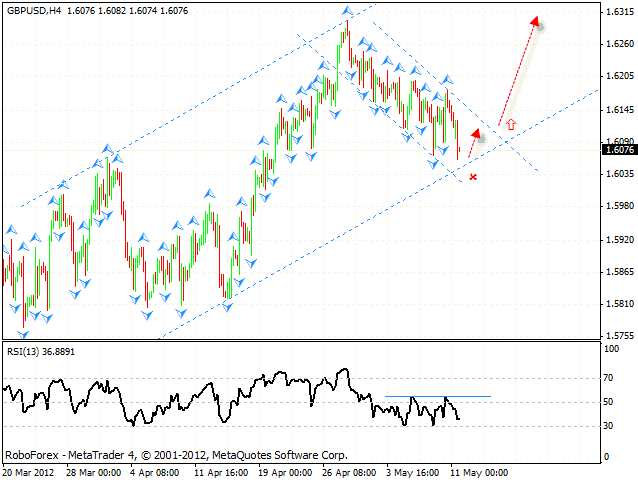

GBP/USD

The GBP/USD currency pair hasn’t grown up as high as we expected. Right

now the price is very close to the ascending channel’s lower border. One

can consider buying Pound from the current levels with the stop below

1.6050, and increase the amount of long positions only after the price

breaks the level of 1.6185. The target of the ascending pattern is the

area of 1.6510.

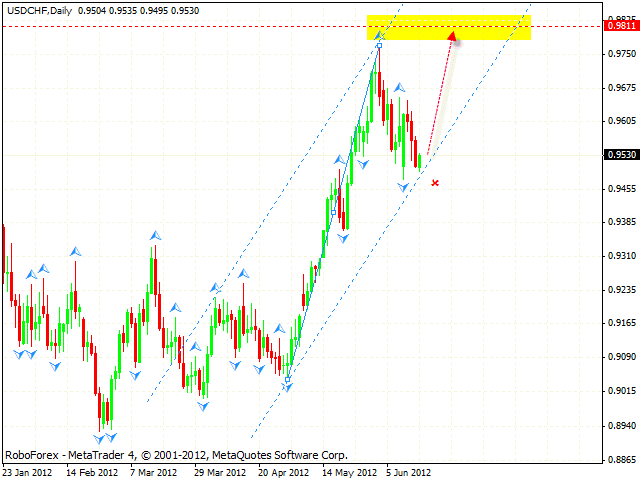

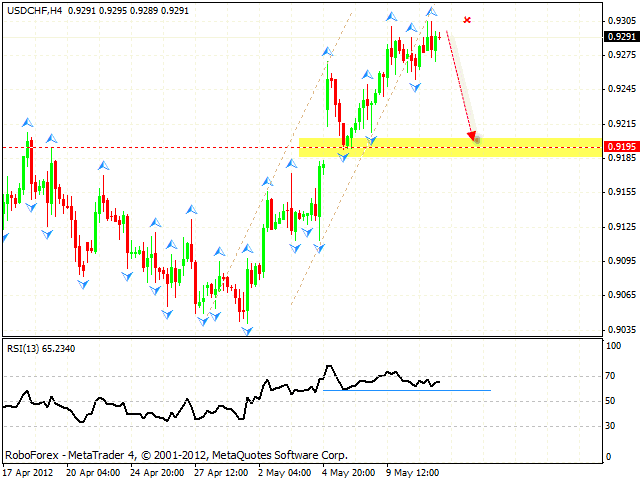

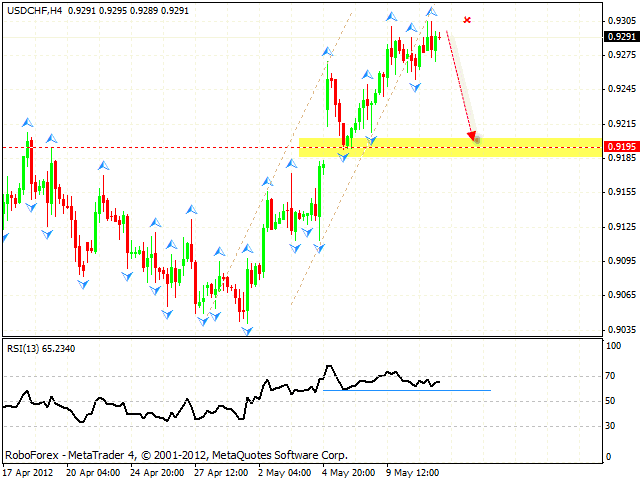

USD/CHF

The USD/CHF currency pair is slowly trying to test the local maximums.

At the H4 chart the price is forming “failure swing” reversal pattern at

the RSI. After the price breaks a support line at the RSI, the pair may

start falling down towards the area of 0.9195. One can consider selling

Franc with the tight stop above 0.9305, and increase the amount of

short positions only after the price breaks the level of 0.9245.

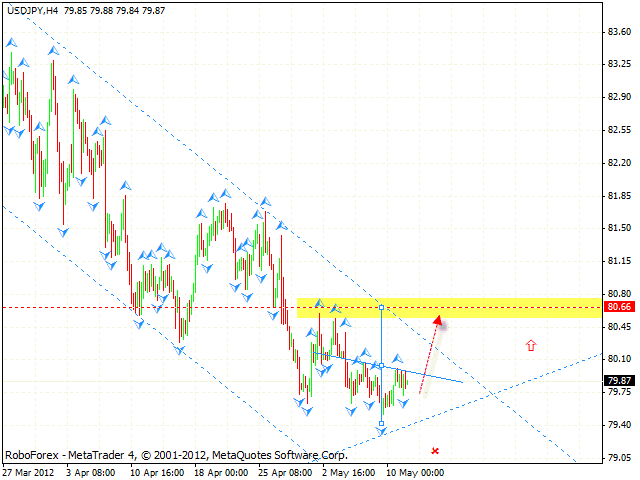

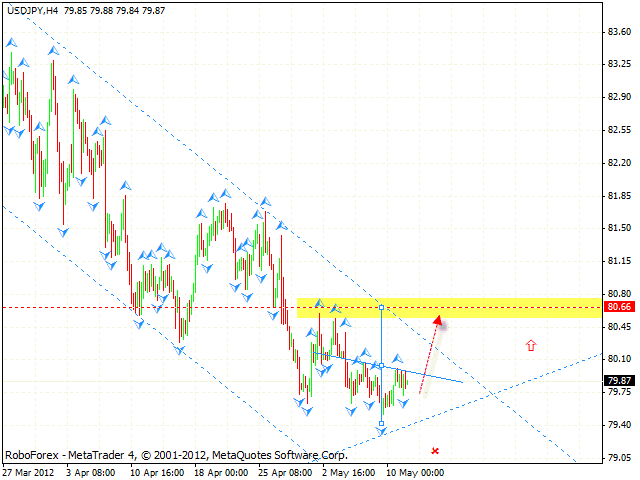

USD/JPY

Yesterday we discussed the USD/JPY currency pair. Currently the price is

testing the ascending channel’s lower border and forming “head &

shoulders” reversal pattern at the H4 chart. One can consider buying the

pair with the tight stop below 79.70, the closest target of the growth

is the area of 80.65. Conservative traders are advised to wait until the

price breaks the level of 80.05 and then try to buy the pair.

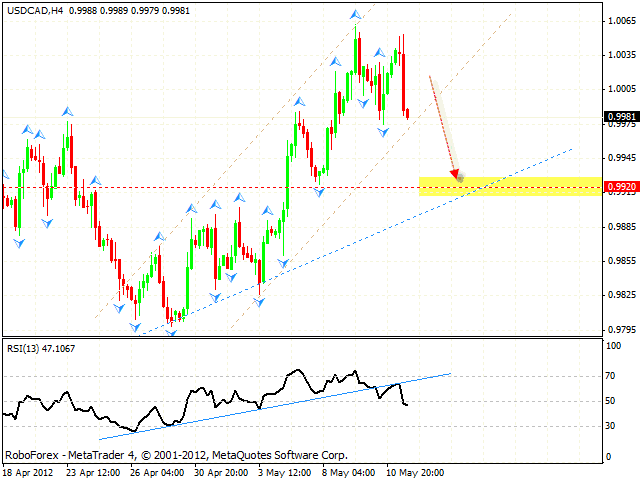

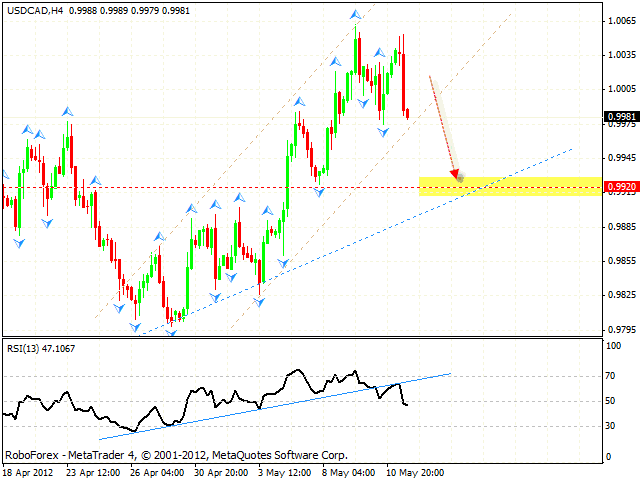

USD/CAD

Although we didn’t expect this, but Canadian Dollar has grown up.

However, there is still a possibility that the price may start falling

down. One can consider selling the pair from the current levels, the

closest target of the fall I the area of 0.9985. If the pair breaks this

level, it will continue falling down towards the area of 0.9920. If the

price continues growing up, this scenario will be cancelled.